Inflation Is “Under Control,” Unless You Buy Food, Pay Rent, or Have Kids

December’s CPI looks calm only because energy prices fell and last year’s tax break is doing one final favor

That is the story Statistics Canada’s December 2025 Consumer Price Index quietly tells, even if Ottawa would prefer Canadians stop reading after the headline number.

Officially, inflation rose 2.4 percent year over year, up from 2.2 percent in November. Government-friendly commentators will call this “stable.” That word does not survive contact with the details. The increase had little to do with newfound price discipline and everything to do with a temporary GST/HST tax break that artificially lowered prices in December 2024 and has now vanished from the annual comparison. Roughly 10 percent of the CPI basket was affected by that tax holiday. When the distortion disappears, inflation mechanically rises.

Strip out gasoline and inflation jumps to 3.0 percent, well above the Bank of Canada’s target. This matters because gasoline prices fell 13.8 percent year over year, masking the real cost pressures facing households. Energy prices declined because global oil markets are oversupplied and crude prices are at their lowest level in more than four years. This is not the result of domestic policy brilliance. It is the result of forces entirely outside Ottawa’s control.

Food prices continue to punish families. Grocery prices rose 5.0 percent year over year. Coffee climbed an astonishing 30.8 percent. Beef increased 16.8 percent. Meat overall rose 8.5 percent. Restaurant prices surged 8.5 percent, up sharply from 3.3 percent the previous month. Statistics Canada itself identifies restaurant food as the single largest contributor to the acceleration in inflation. That means eating at home is expensive and eating out has become a luxury.

Shelter costs remain elevated. Overall shelter inflation sits at 2.1 percent, with rent up 4.9 percent, making it one of the largest upward contributors to the CPI. Statistical offsets like homeowners’ replacement cost declining 1.6 percent soften the headline but do nothing to reduce monthly rent cheques.

Services inflation tells the deeper story. Services, which make up 55.5 percent of the CPI basket, rose 3.3 percent year over year. Services inflation is slow-moving and stubborn. It reflects wage pressure and embedded costs.

Regionally, inflation accelerated in nine of ten provinces. Manitoba led at 3.7 percent. Quebec posted 3.2 percent. British Columbia recorded 1.7 percent, largely due to a one-time collapse in traveler accommodation prices following last year’s Taylor Swift concert-driven spike.

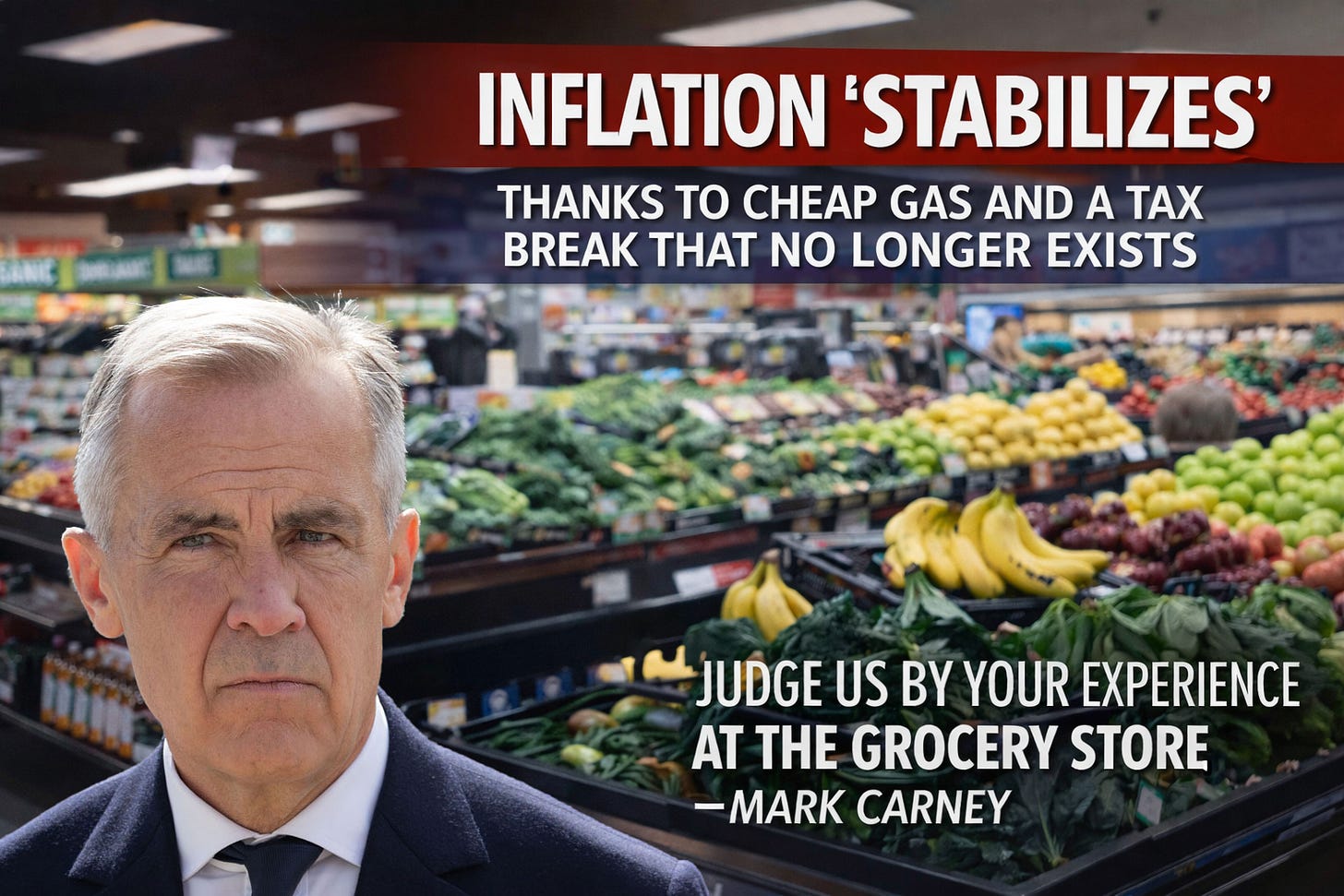

Prime Minister Mark Carney once told Canadians to judge his government by their experience at the grocery store. The December report delivers that judgment clearly, and it’s damning.

Canada’s headline inflation numbers are being artificially held down by plunging energy prices and the fading echo of a brief tax holiday. Meanwhile, food, rent, services, and everyday family essentials continue to climb faster than incomes. If energy prices turn upward again, the whole mirage collapses in an instant.

For Canadians who feel their bank accounts shrinking despite the comforting headlines, the explanation is staring them in the face. Inflation hasn’t been defeated. It’s been cosmetically concealed.

Source: Statistics Canada, Consumer Price Index, December 2025

Like all of Dan's articles, this is an enjoyable and informative read.

A couple of points might add some context.

First of all, the CPI and inflation are not synonymous. CPI is an indicator of inflation, but not a definition. This is a subtle, but important distinction. Inflation is the rate at which the general price level increases over time, but not all price adjustments are inflationary; nor should all price adjustments be measured as such. So, Dan mentioned that gasoline prices have fallen due to supply issues; this is a market price adjustment that is independent of inflation.

This is precisely why Pierre Poilievre was able to rightly predict that the inflation of 2022 was not transitory, but was, in fact, endemic to the growth in the money supply. Bankers waited too long to put on the monetary brakes, after printing too much money for too long during and after COVID.

Central Banks are inflation machines. That is, they exist to create inflation, among other things, of course. The stated goal of most Central Banks is to create an inflation rate of two per cent. It is important to note, that at 2 per cent inflation, prices double every thirty-five years.

It is interesting to take a moment to research the foundation for the two per cent target. Is it founded in economic theory? Why 2 per cent? Why not 1 per cent or 0 per cent? Why not adopt a rules-based system where the money supply grows at, or near, the rate of growth of the economy?

It turns out it was more of an offhand idea by the Reserve Bank of New Zealand than a strictly derived policy prescription. The Bank first suggested 0-2, then 1-3, and then settled on 2. The Bank of Canada soon followed.

I have found the best way to think about inflation, is this little story: many years ago, when I was a younger man, I had a crush on a girl who was the sister of a friend of my brother. We were 12 or 13. I would invite her over to watch television. I would go out, buy a bottle of Pepsi or Coke, and serve it like champagne. The bottle cost $.79 plus deposit. (pop came in glass bottles in those days)

Now, that bottle costs $3.99 or more. Has Pepsi or Coke changed its formula to taste better? Has soda pop demand increased so much that it has outstripped the supply, or outflanked all substitutes? If anything, productivity increases and near substitutes would have a downward effect on prices.

What has happened is a deliberate fifty-year debasement of our currency. A Canadian dollar today buys only about 14% of what it could in 1973. In other words, $100CDN in 1973 had the same purchasing power as $702 does in 2026. (Source AI Google)

Finally, Canada has a production problem. We do not produce enough. We have all heard about the productivity crisis, but what does it actually mean? Since 2018, US real manufacturing growth in GDP increased by 10 per cent. In Canada, it fell by 5 per cent. Canada now has the smallest manufacturing sector in the G7.

As the saying goes…”you can fool some of the people some of the time, but you can’t fool ALL of the people ALL of the time.” The world is in a colosal mess, with world leaders living in an elite fantasy world. Common sense appears to be severely lacking. Money and power dominate.